Provision of legal advices regarding obtainment of non-profit status in Ukraine and tax aspects of not-for-profit activities

What we do

-

We analyze the charter to determine the possibility of obtaining non-profit status for the NGO or prepare the charter with needed articles by ourselves;

-

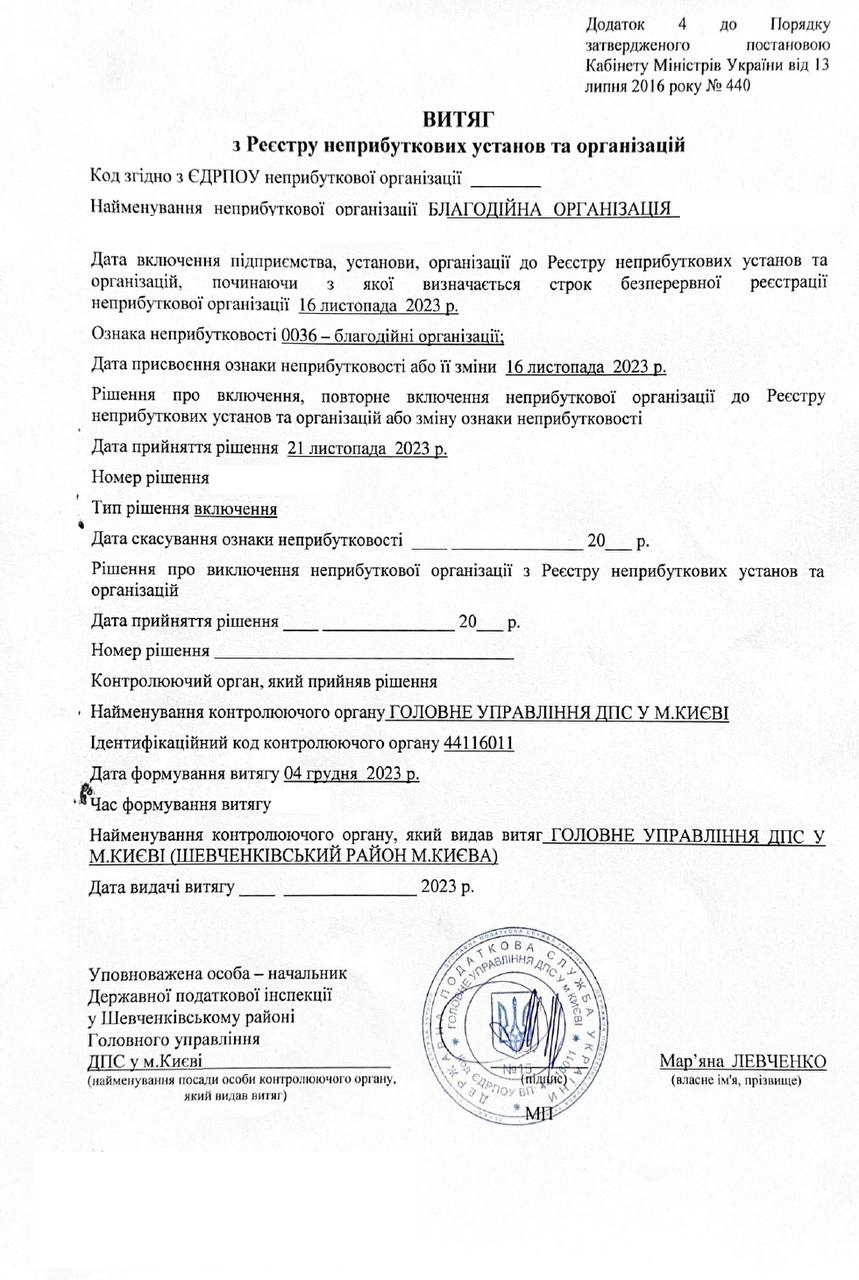

We prepare and submit a package of documents to the tax authority;

-

We provide advice on maintaining the non-profit status;

-

Advise on taxation and its optimization for non-profit activities.

Non-profit status can be obtained by submitting an application to the tax office after registration of the NGO. The procedure itself is not complicated - you apply and wait for a decision. But whether you will be granted the status depends primarily on how your Articles of Association are drafted and what documents you submit. You can apply in different ways, our lawyers will choose the most convenient one for you, having fully prepared the whole set of documents. The peculiarity of our company is that we try to provide answers to any questions you may have about the activities of not-for-profit organizations in Ukraine. This implies that we have lawyers of various profiles, including tax specialists. Such a specialist will not only be able to take care of maintaining the status of non-profit, in accordance with the requirements of the law, but will help to understand the issues of commercial activities, if any, tax returns and others. We will put the whole puzzle together for you, taking care of all the legal aspects of your security so that you can get on with what matters most - achieving your NGO's goals.How to obtain non-profit status in Ukraine?

Non profit tax lawyer Ukraine

WHY CHOOSE US

-

Full support for the work of NGOs

Obtaining a non-profit status is just a small step to starting a non-profit activity in Ukraine. In your work you will face a thousand questions about how to organize it properly in Ukraine. We know how. Moreover, we will undertake legal and accounting protection of your NGO. -

Protection of non-profit status

Once non-profit status is obtained, the most important task is not to lose it. And this is easy to do if you do not comply with the rules of taxation, distribution of funds to NGOs or reporting. Our team will not only help you obtain the status, but also tell you how to avoid losing it.

You will need to collect and prepare a number of documents that will testify to the non-profit nature of your activities in Ukraine. The main document here will be, of course, the Articles of Association. It should contain provisions stating that the organization does not plan to make a profit, how exactly the funds received into its accounts will be distributed, and what are the goals of the NGO's activities. We have drafted dozens of such charters, designed for each specific organization. The tax office to which you will apply for the status may also require other documents on the registration of the NGO and proof of the nature of its activities.What documents will be required to obtain non-profit status?

REFERENCES FROM OUR CLIENTS

Important to know

Having a nonprofit status does not mean that you may not file reports or keep accounting records. On the contrary, it should encourage you to be doubly responsible in filing reports, because you risk losing your status and having your taxes recalculated. Moreover, any nonprofit organization has a number of taxes it must pay. For example, if you have employees. The state exempts NGOs from paying only income tax. Our company offers you the services of professional accountants and lawyers who will take care of all the accounting of your activities. We will help with the organization of the accounting system and take care of filling in and filing all the necessary reports. Do you need help? Contact us! We know exactly how to organize NGO work in Ukraine and will go all the way together with you.Non profit organization tax filings in Ukraine

SWIFT OBTAINMENT

AND BEST QUALITY PROVEN BY YEARS OF PRACTICE!

Volodymyr Gurlov, Managing partner