Bookkeeping and accounting for non-for-profit organizations

What we do

-

We organize the whole process of accounting of NGO activities in Ukraine.

-

We will advise on the best ways to conduct activities taking into account the non-profit status.

-

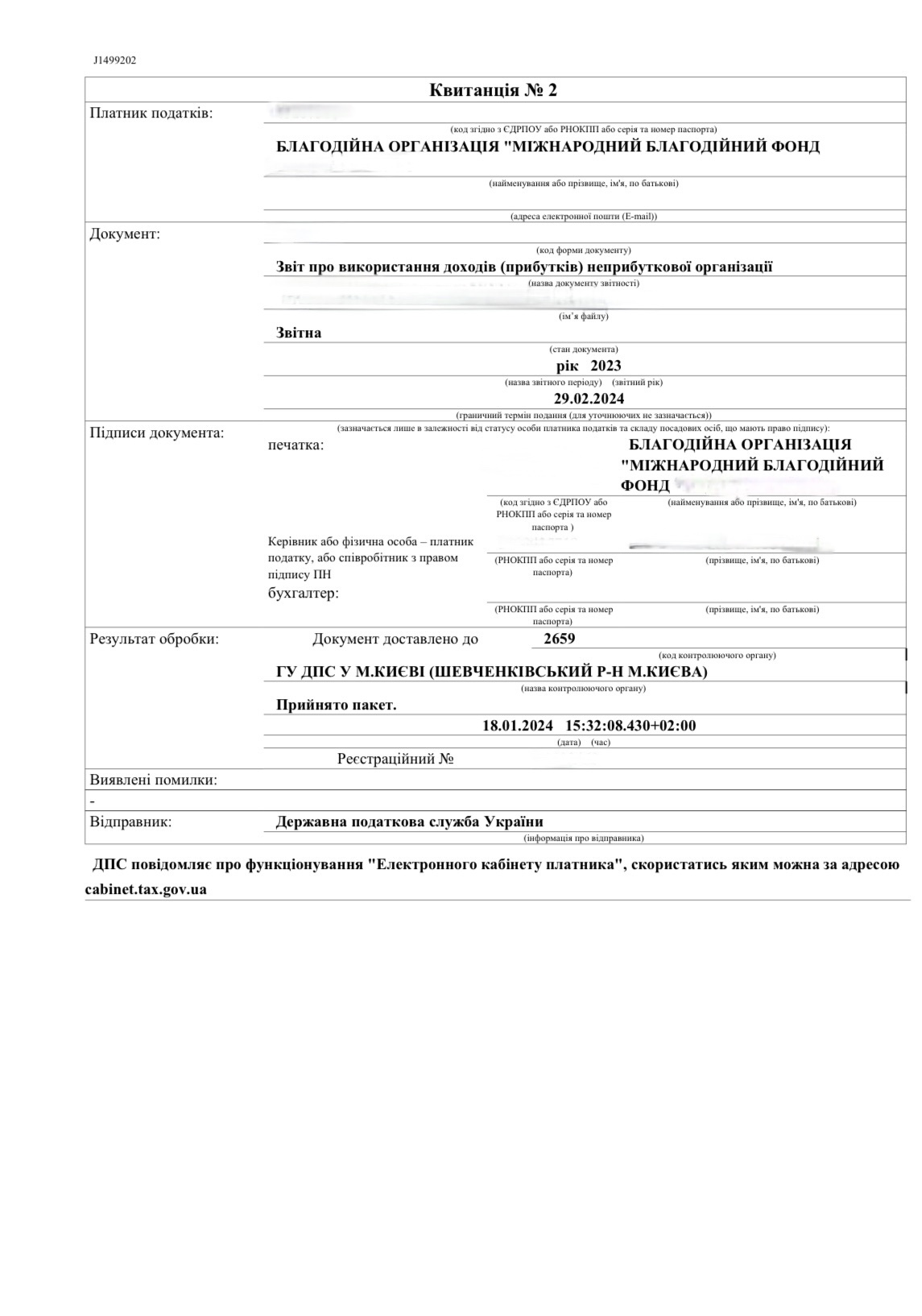

We will prepare and submit independently all necessary reports on NGO activities, including the annual report.

-

We provide all necessary services in one place: legal counseling, opening bank accounts, accounting and personnel records, payment processing and much more.

-

We are ready to solve specific tasks related to the foundation's activities, such as inclusion in registers, organization of work with volunteers and others.

Funding for a charitable organization is primarily from donations from benefactors. These funds should be used strictly in accordance with the goals and mission of the organization. The task of the accountant and lawyer at this stage is to clearly monitor the distribution of incoming funds within the entity. Obtaining the status of a non-profit organization means that it does not make profit from its activities and, therefore, is not obliged to pay profit tax. But here it is important to understand how to maintain the status of non-profit and what the tax authorities may regard as profit making. This is where a combination of a lawyer and an accountant, who complement each other with experience and knowledge in their respective fields, becomes useful. Our work will start with a consultation, where you will get to know a more in-depth list of our services, and we will get to know how you see your business in Ukraine and what kind of help you need. We are confident that we can offer you the best specialists with the right experience. After all, we have been working with more than one NGO on the Ukrainian market for many years.Accounting for non for profit organizations in Ukraine

WHY CHOOSE US

-

Accountant + Lawyer

Your task will be supervised not only by an accountant who keeps the records, but also by a professional lawyer who will scour all the latest changes in legislation. This is the duo that will make sure that your organization is completely safe and your non-profit status is maintained. -

Full service

Our specialists help not only with accounting services, but will also provide legal assistance on any issues arising for NGOs. You will have access to the best lawyers in Ukraine specializing in servicing non-profit organizations.

Based on our practice, the main problems that a non-profit organization in Ukraine may encounter in its activities and accounting are: Confusion about the organization's spending. As mentioned above, the funds coming into the NGO should be used for the purposes specified initially in the Charter of the organization. This is why it is so important to involve a lawyer at the stage of creating an NGO - how you spell out the activities in the Charter is how you will have to play by the rules afterwards. When funds are deposited into the account of, for example, a charitable foundation, it is extremely important to immediately determine their intended purpose, to understand what kind of aid can be accepted under what type and for what expenses, as well as to record all financial transactions in the accounting records. Otherwise, you can get unnecessary questions from the tax authorities and lose your non-profit status. Organizing the work of volunteers and staff. Of course, this is more related to the personnel service, but only in terms of setting the work. The accountant, on the other hand, will keep records and payroll, if it is an employee, or funds to work with volunteers. It is important to remember that a volunteer and an employee are completely different things, and the accounting of work with them should be organized differently. Enforcing the 80/20 rule in a nonprofit organization. In simple words - of course NGOs can spend the funds received for their needs, as otherwise such organizations can exist. But such "administrative" spending should not exceed 20% of annual income as required by law. The task of the accountant and lawyer is to monitor this proportion, taking into account all the activities of the NGO.Bookkeeping services for non profit organizations in Ukraine

REFERENCES FROM OUR CLIENTS

Important to know

The accountant of a non-profit organization in Ukraine must submit the following reports: Financial statements: include the balance sheet, statement of financial performance (income statement), and statement of cash flows. Tax reporting: includes declarations for value-added tax (VAT), personal income tax, corporate income tax (if applicable), and other applicable taxes. Financial and economic activity report: contains information on the income, expenses, and use of funds of the organization for a certain period. Cash flow statement: reflects the inflows and outflows of cash of the organization for a certain period. Statement of financial position: provides information on the current state of the organization's assets and liabilities. Of course, the order of reporting requirements for each specific organization will be determined by how exactly you conduct your business. Also note that during the war period, some of the requirements for form, procedure and terms for filing reports may change - our accountant will keep an eye on this at all times. Do you want to outsource your NGO's accounting work to someone else? We are ready to help you! Contact our staff for a personalized package of services.What reports do our accountants file for your NGO in Ukraine?

SWIFT OBTAINMENT

AND BEST QUALITY PROVEN BY YEARS OF PRACTICE!

Volodymyr Gurlov, Managing partner