Tax return preparation and filing

What we do

-

Providing tax counseling;

-

Organization of tax accounting and tax filing process;

-

Analyzing your tax documentation;

-

Assistance in preparing for tax audits;

-

Tax optimization;

-

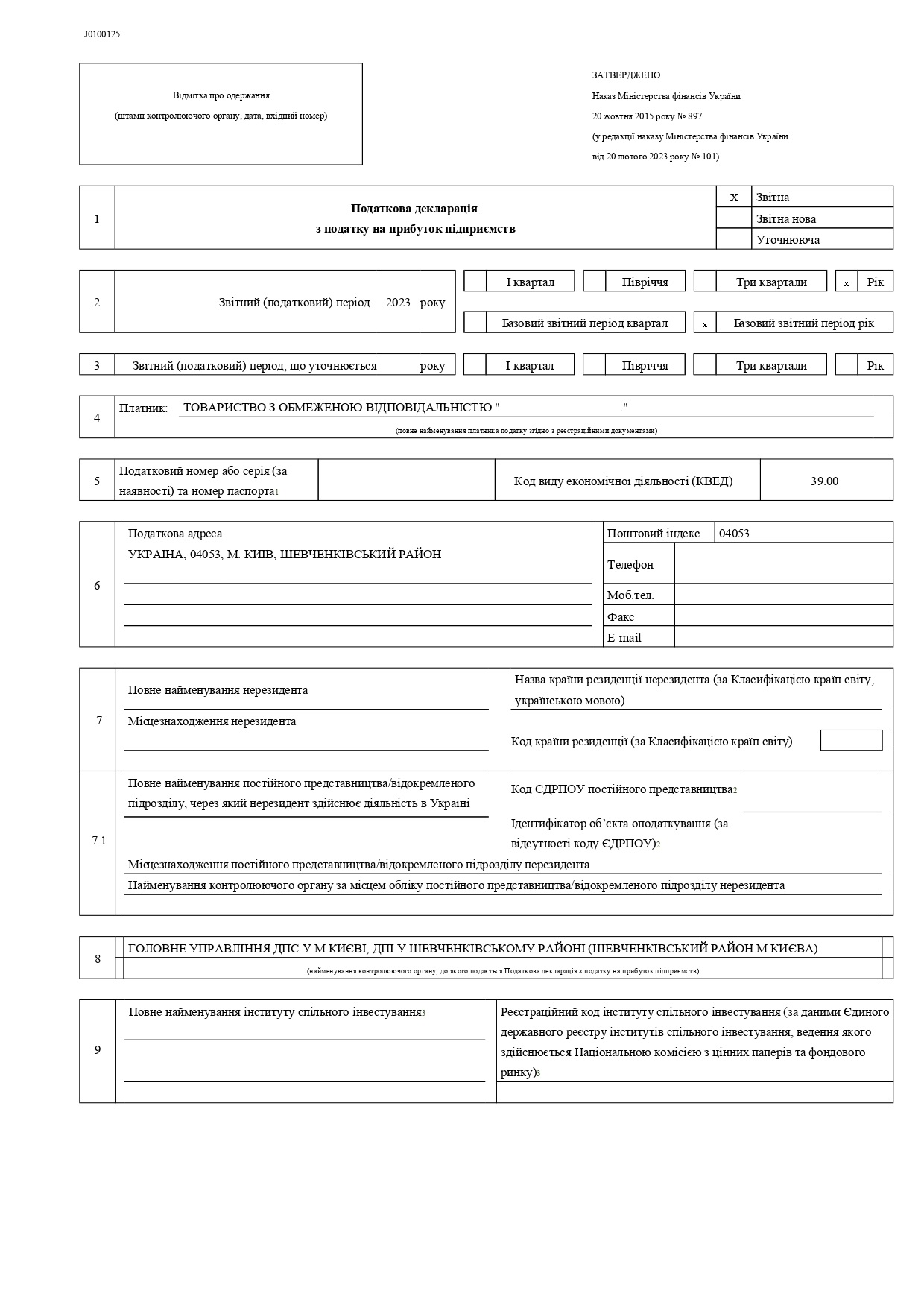

Income tax declarations preparation and filing;

-

Personal income tax declarations preparation and filing;

-

VAT returns preparation and filing;

-

Single taxpayers declaration preparation and filing.

Filing a tax return is, in fact, filing tax reports about your activities in Ukraine. What kind of declaration to file will depend on what form of business you have registered, what period of the year it is, and what taxation system you have chosen. Important! Declaration is not the only report that you have to submit, so you need an experienced accountant to organize the whole process. This is what we offer you. Our company offers the services of a team of an accountant and a lawyer, who will jointly take care of tax accounting and reporting of your activities. If there is a possibility to guarantee your legal security when doing business in Ukraine - it is with the participation of a lawyer in the process. For executives and business owners, we also assist with the preparation and filing of individual income tax returns.Filing of income tax returns in Ukraine

WHY CHOOSE US

-

Help from a tax lawyer

Having access to a tax law specialist, you will receive answers to questions that relate not only to your business activities, but also to personal taxation. -

All accounting is on us

We will not just generate and submit a tax return for you, we ourselves will keep all records of your activities, calculate taxes payable and monitor the timeliness of reporting.

Correct and timely filing of tax returns is especially important during the period when tax audits and inspections are resumed in Ukraine. If we are talking about personal income tax returns, it is also worth taking care that the documents are filled out correctly. The tax legislation of Ukraine has changed quite often before, and during the war the rules can change within a couple of days. An experienced lawyer is a guarantee that any changes important for your legal security will not go unnoticed. To file tax returns and tax returns with us you need to: Provide us with all information about the person (legal entity or individual) who is to file tax returns; Provide all available documents that are relevant to the activity for the reporting period; Give information to a lawyer and accountant upon request; Give access to your electronic office for your accountant and lawyer. From there, you can relax and go about your business while we take care of filing the reports for you. We help with the filing: Income tax declarations; Personal income tax declarations; VAT returns; Single taxpayers declarations.Tax return preparation service in Ukraine

REFERENCES FROM OUR CLIENTS

Important to know

If we are talking about the tax reporting of Sole proprietorship (FOP) in Ukraine, for example, then today there is an opportunity to file a declaration online. To do this, you will have to fulfill several mandatory conditions, first of all - sign an agreement on the recognition of electronic reporting. All this can be organized for you by an accountant who has access to your electronic account. Our lawyers control both the filling in of the tax return itself, in accordance with the requirements of the law, and its submission online. Do you need help with bookkeeping of your business? Contact us! You will get much more!What is the state's policy on filing returns online?

SWIFT OBTAINMENT

AND BEST QUALITY PROVEN BY YEARS OF PRACTICE!

Volodymyr Gurlov, Managing partner