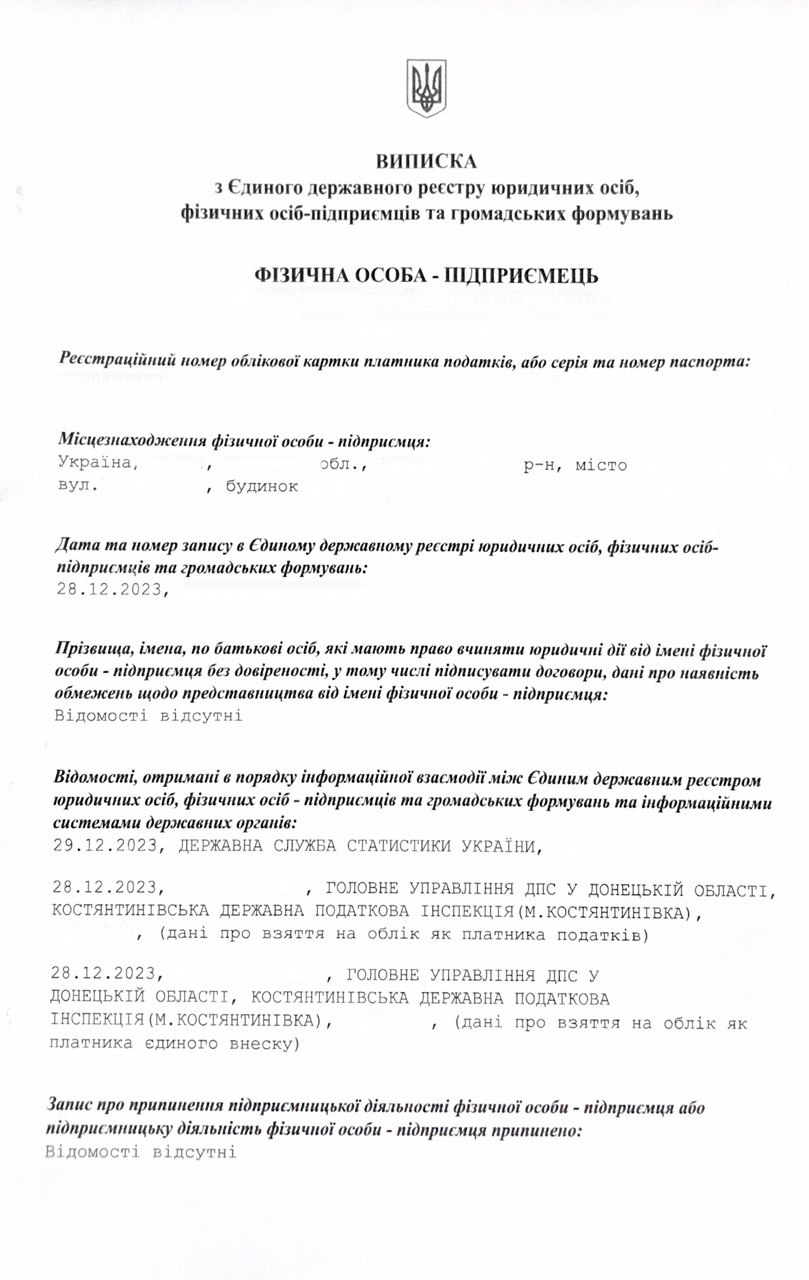

Registration of sole proprietorship in Ukraine

What we do

- Advise you on the registration procedure;

- We will tell you, based on your situation, whether such registration is possible for you;

- We will determine your goals in Ukraine and choose the best option for conducting business;

- Help with registration and preparation of documents;

- Help you not to get confused in tax systems and choose the right option;

- We will offer accounting services, at least for the first time;

- Develop for you drafts of the necessary documents to start work;

- Provide all the necessary business consultations;

- We will take care of the calculation and payment of your taxes with accounting support;

- Help to open a bank account for both individual entrepreneurs and personal ones.

Registration of a private entrepreneur for a foreigner can have both pros and cons. Moreover, they will be individual for each situation. But if you look at the question more broadly, then standard advantages can be called: In the same way, we can identify general disadvantages: But there may also be personal factors that outweigh the pros or cons. Therefore, our first task, as lawyers, will be to determine whether registering a sole proprietorship is really what suits your goals and plans in Ukraine. Why do you want to register this particular form? Based on your needs, we will weigh the pros and cons, and offer you a truly profitable option, based on how things work in Ukraine.Register a sole proprietorship in Ukraine

1. Less hassle with reporting. It's simpler, there's less of it. It's still there though and you have to serve it.

2. You can indicate your registration as an address, the main thing is that you have one.

3. There is no obligation to set your own salary; you only work with income and taxes on it at the rate you choose.

1. The company can simply be sold. This will not work with a private entrepreneur; you will have to close it and undergo verification.

2. The main issue is that you are responsible with your property.

3. If we are talking about a foreigner, you must already have grounds to stay in Ukraine.

4. There are types of activities where this form simply will not work.

WHY CHOOSE US

-

All services in one place

We will not only register sole proprietorship for you, but will also help with the organization of the work itself: preparation of contract drafts, business and legal consultations, migration services and much more. -

Accounting support

Our firm offers the services of not only lawyers, but also a professional team of accountants. Your documentation and trading operations will be under complete control.

Yes, of course. But among the clients who contact us, for some reason there is an opinion that opening an individual entrepreneur in Ukraine will also give them the opportunity to obtain a residence permit, but this is not the case. On the contrary, you must have a residence permit, and then, if you want, you can open a private entrepreneur and further conduct your business through this form of activity. Therefore, this option is suitable only for those foreigners who have other reasons for stay. Let's say through marriage. Another option, which we have already carried out for our clients, is obtaining a residence permit through a company that pays minimum taxes monthly, and the parallel opening of a private entrepreneur, through which the activity is actually carried out. But to understand whether this is profitable for you, you need to sit down and make calculations, taking into account the type of your activity, expected turnover and other factors. If your goal is to run a real business in Ukraine, we will make the following calculations for you and select the best option. If your goal is to obtain a residence permit, we will offer an alternative, truly working option, without spending your money and time on opening an individual entrepreneur.Can foreigners undergo the registration of a sole proprietorship in Ukraine?

REFERENCES FROM OUR CLIENTS

Important to know

Registration of a private entrepreneur takes place within one day. Of course, with proper preparation, pre-issued tax identification number and legalized stay. But what next? After all, you opened a private entrepreneur to conduct business on the territory of Ukraine. In this regard, many questions may arise, especially among foreigners. Starting, of course, with taxation and reporting - but our accountant can easily handle this for a reasonable fee. But there are more complicated questions. What if you operate not only in Ukraine, but also abroad? Does your activity fall under the concept of CFC? How can you pay taxes not in both countries, but remain, for example, on the lenient Ukrainian system? In what situations will a sole proprietor need VAT and how to apply for it? You can find answers to all these questions with us. Do you need the help of a professional lawyer? Contact us and you will no longer need to look for legal consultants for other issues.Legal advice for sole proprietorship in Ukraine

SWIFT OBTAINMENT

AND BEST QUALITY PROVEN BY YEARS OF PRACTICE!

Volodymyr Gurlov, Managing partner