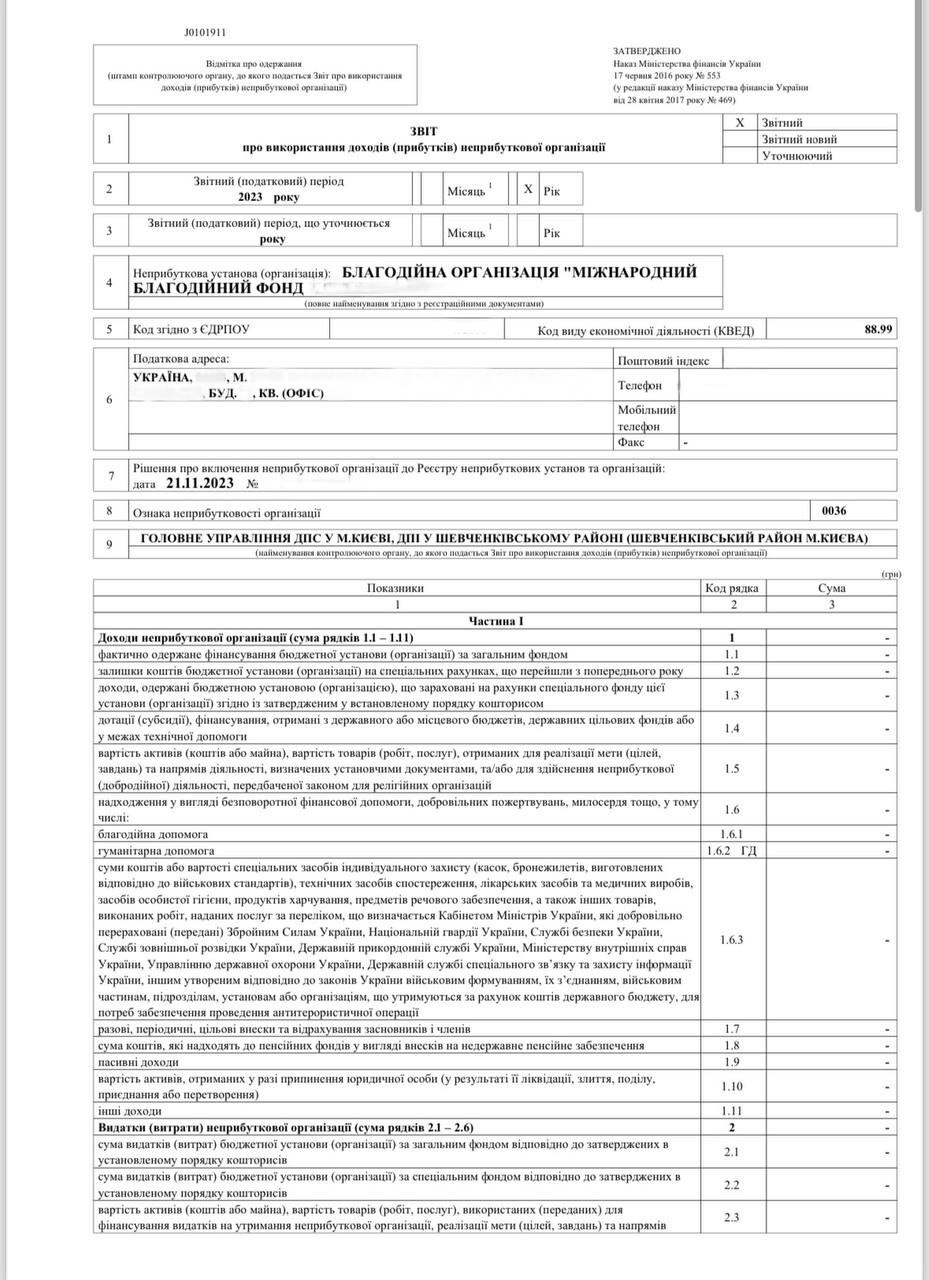

Preparation and filing of blank tax reports

What we do

-

We analyze your activities and the possibility of "zero" accounting;

-

Determine what taxes must be paid and what reports must be filed;

-

We take over the bookkeeping and management of your current account for payment of taxes, for example, unified social tax;

-

Provide advice from a tax lawyer and accountant.

One of the most demanded areas of our work is migration services. We have helped hundreds of foreigners to obtain residence permits in Ukraine. Depending on the grounds, foreigners can apply for different types of residence permits, but one of the most common cases is the registration of a company in Ukraine, where a foreigner is officially employed. Of course, such a company is not obliged to conduct any activity, if the client does not want it. But it must remain open to give grounds for a residence permit, and must not have problems with the law. This means that such a company must file reports on time, even if they are "zero" and pay the established standard taxes for the employee, even if it is one director. Reporting in such a situation for our clients is also handled by us, not just providing them with accounting services, but staying in touch all the time and at arm's length if they need other services.Preparation of tax report in Ukraine

WHY CHOOSE US

-

We work with foreigners

Our team includes not only experienced accountants, but also a lawyer with more than 5 years of experience in the state migration authorities of Ukraine. We help with all types of permits to stay in Ukraine and know what difficulties foreigners face in Ukraine. -

All services in one place

In your daily life, you may find yourself needing to turn to a trusted legal advisor more than once. Purchasing real estate, renewing a residence permit, or even moving a business into activity - our team will help with each of these issues.

Let's say you didn't know how to do it, or you didn't think it was important, or you just don't want to deal with accounting issues. So what happens if you don't file "zero" reports for a company for which there is no activity? Let's look at the first situation that we, as migration lawyers, encounter most often. You have opened a company in Ukraine to obtain a residence permit and do not file reports. In addition, you do not pay a monthly unified social tax. The result is simple - after two months of non-payment of the unified social tax, your work permit in Ukraine can be canceled, which means that the basis for residence permit is lost. You lose the opportunity to legally stay in Ukraine, and you will be able to apply for a new residence permit only after a long period of time - a year at least. The second situation: your stay in Ukraine does not depend on the presence of a company, but for some reason you have it. And you do not file reports on the non-working company. In such a case, you will be fined for the late filing of reports. The first fine will be followed by a second fine. And if the situation is repeated, expect audits and the active involvement of the tax authorities in the affairs of your, albeit dormant, company.What happens if reports are not filed?

REFERENCES FROM OUR CLIENTS

Important to know

When organizing record-keeping for your company, we will require copies of your articles of incorporation, as well as all registration documents for registration with the state authorities of Ukraine. We will also ask you for copies of your director's passport documents and access to an electronic seal, if you have one. Our accounting department keeps accounts for many clients, so we will organize the whole process ourselves. Do you need the help of a lawyer or accountant in Ukraine? Contact us! We will take care of your security!How are reports submitted by our accountant?

SWIFT OBTAINMENT

AND BEST QUALITY PROVEN BY YEARS OF PRACTICE!

Volodymyr Gurlov, Managing partner