Company registration in Ukraine

What we do

- provide legal advices on the matters of optimal structure of corporate rights in the LLC;

- provide draft of minutes (protocol) of the parent company by means of which the company makes the decision about LLC establishment in Ukraine, draft of power of attorney from the parent company for its representative;

- draft bilingual corporate charter (articles of incorporation) of the company (in Ukrainian and English);

- draft all other required documents and organize communication with governmental authorities in order to register company within the shortest possible term;

- provide additional services – nominal address and nominal manager (director, CEO) that are needed to easily open business in Ukraine;

- advise on the matters of employment of foreigners and temporary residence permits for them.

We open an LLC in 3 business days without any delays.Terms and cost of the company registration in Kyiv

You can register a business not only in a government agency, but also through authorized representatives. We can organize this.

This service is our firm’s standard procedure, the final cost of which depends on nominal services chosen by a Client - for example, if you need the services of a nominee director for a specified period.

Cost of our services related to starting the private limited liability company in Ukraine is agreed upon with each Client separately and depends on the complexity of documents drafting, amount of required preliminary legal advice and nominal services.

The Ukraine company registration cost calculations mostly depend on the complexity of the project, as well as the need for the lawyer to provide additional advice. For example, concerning tax optimization of business in Ukraine, or solution of migration issues for the owner of the business.

Successfully rendered services

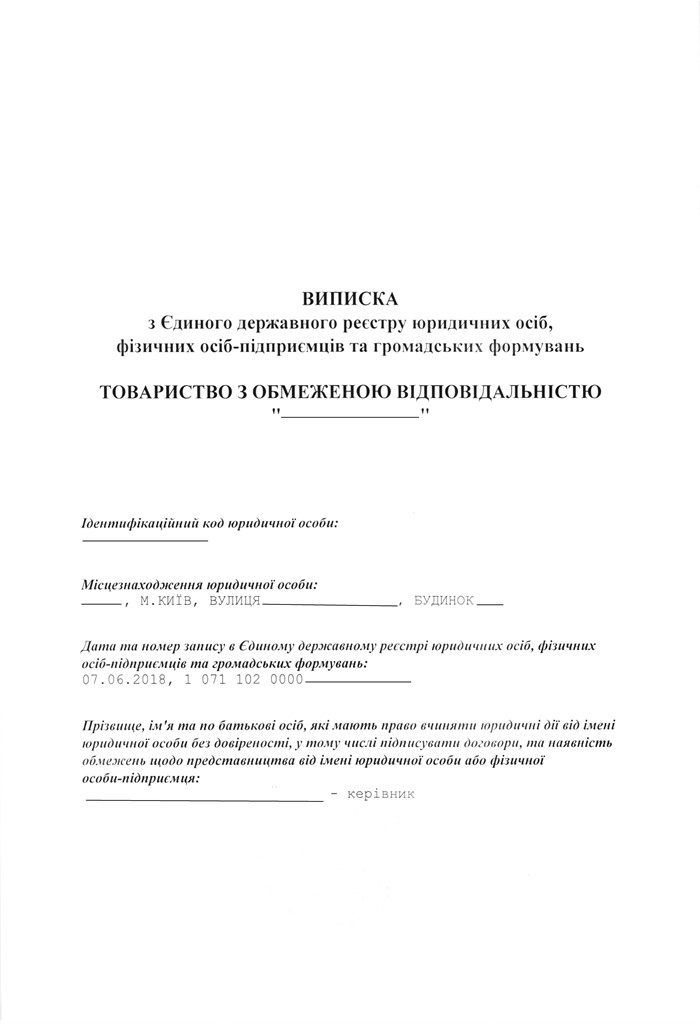

Registered a company in October of 2016

Provided legal services of incorporation in Ukraine for an investor from European Union. The legal entity was established in the form of limited liability company with the registration address in Kiev. Specialization: IT, software development, telecom. Scanned copy of registration certificate.

WHY CHOOSE US

-

We can provide our CEO (Head of the office)

At the moment of registration it is commonly better to set a Ukrainian citizen as the CEO. We can provide You with such person that can be replaced as soon as all procedures will be finished. -

Nominal legal address for the registration

If You don’t have an address or have no intention on having the office at all - we can provide You with the nominal address for the registration and provide it with further postal services.

Required documents for company registration in Ukraine

-

Copy of ITIN certificate

Copy of ITIN certificate

-

Copies of establishers passport

Copies of establishers passport

-

Power of attorney

Power of attorney

In Ukraine, business registration for non-resident individuals will require: copy of Ukrainian ITIN certificate (if a non-resident does not have one, our lawyers will help to get it); scanned copy of passport; power of attorney for employees of our firm, which includes power to perform all actions related to registration of the LLC. notarized copy of extract from trade, court or any other register which proves registration of the legal entity and is certified by means of apostille; notarized and apostilled certified copy of the minutes of the meeting of the directors, which made the decision to establish an LLC in Ukraine, and the register of members of the board of directors (draft documents will be prepared by our lawyers); notarized and apostilled power of attorney for the employees of our company, which includes the authority to perform all actions related to the registration of the LLC. Preparing the documents; Getting the documents on LLC registration to the state registrar; Obtaining a Registration Statement.Registration of a company in Ukraine by foreign individuals or legal entities

If a foreign legal entity becomes a party to a company in Ukraine, it must provide:

Procedures for registering a company in Ukraine

The registration procedure itself takes only 1 day. But preparation for it, including the development of the Charter and other documents, can take several days. This will all depend on the complexity of the company's structure, the number of shareholders, the business management system and other nuances.

REFERENCES FROM OUR CLIENTS

Important to know

Limited liability company is the most popular option for business registration in Ukraine. The founder can be a person or a legal entity, as well as a combination of legal entities and individuals. The maximum number of participants is not limited, and the minimum is 1 participant. Company registration in Ukraine serves as a good ground for obtaining a temporary residence permit for its foreign founders if they obtain management positions in the LLC. The permit is issued for the period of up to two years. When searching information about companies that are already registered in Ukraine, you can have free access to the official state register online. During martial law, you can only enter it using an electronic signature obtained at one of the relevant certification centers in Ukraine. The register allows you to find a company formation either by its name or registration number, as well as provides information about its legal address in Ukraine, current director (CEO), list of founders and their shares in charter capital etc. For example, the register contains information about bankruptcy procedures initiated regarding certain legal entities. Information from the official state register may be useful for official correspondence with Ukrainian firms since sending formal letters (including complaints) to the legal address specified in the register is recognized as due by all authorities in Ukraine, including judicial bodies. At the same time the actual location of the company’s office is not that relevant. We offer you not only the registration of the company, but the selection of the best option for the solution of your issue. Thus, the registration of LLC can be chosen, for example, for starting a business in Ukraine, or to solve the issue with the relocation to Ukraine (obtaining a residence permit through the opening of a company). In any of these cases, the registration of the company - only one of the steps to achieve the goal. We will offer you full support and a solution to your problem. All in one place, with a professional English-speaking lawyer in Kyiv. Is it cheap to open a company? Depends on the risks you are willing to take. We can surely tell that simply registering a company can be cheap, as it is not a complicated procedure. But if you plan to do business activities, open bank accounts in Ukrainian currency, earn your money without problems or additional expenses - you will need legal consulting. It is better to plan your business wisely, spending a little more on preparation and business analysis, than to end up with losses or fines. Registering a company is not difficult. It is difficult to do it the first time, so you do not have to make numerous corrections later because you planned it incorrectly. Taxes and how they will work for your business are among the most important issues that must be resolved BEFORE registration. For this, our company employs tax lawyers and accountants together. Here is what you need to know about taxes for business in Ukraine. It is suitable for large and medium-sized enterprises with large revenues, significant expenses and complex operations. It can be relevant for your business, if you plan to operate in several industries, export-import, or need to optimize costs or cooperate with international partners. Currently, taxes on this system have the following rates: Corporate income tax: 18% of net profit (income minus expenses). VAT (value added tax): standard rate of 20%. A reduced rate of 7% applies to certain categories of goods (e.g. medicines). SSC (single social contribution): 22% of the payroll, paid by the employer. PIT (personal income tax): 18% for salaries and other income of individuals. Military: 10% of the income of individuals. It is designed for small businesses, individual entrepreneurs, farms, and startups that have limited revenues and a limited number of employees. It is beneficial for freelancers, small shops, catering establishments and workshops. For now, the tax rates can vary on this system, depending on the type of activity: First group: 10% of the subsistence minimum. Second group: 20% of the minimum wage. Third group: 5% of income (excluding VAT) or 3% (including VAT). If we are talking about a business that will cooperate with your existing business abroad, or you simply plan to have suppliers or clients outside of Ukraine, you need to take care of international tax rules. First of all, you can think about such nuances: Tax treaties; Double taxation; Taxation of foreign income and its declaration; International VAT on exports and imports of goods and services; Currency control for financial transactions with foreign partners, etc. The second important point when planning a business is the hiring system. This is especially important for such types of businesses as IT companies because they have at least three schemes for hiring employees: Employment contract; Work through a sole proprietorship; Gig contract. Hiring personnel must be accompanied by documented relations. You must choose the type of contract that you will sign with the employee. If you plan to transfer foreigners to some positions in Ukraine, they will need to obtain a work permit. Each officially employed employee is a tax burden for the company, which you must take into account. In addition to hiring, you will need to document vacations, business trips, sick leaves, dismissals and other aspects. The main provisions of employment contracts in Ukraine include: obligations and rights of the employee and the employer; working hours; remuneration conditions; vacations; duration of the probationary period, etc. The employer is obliged to withhold and pay taxes from the employee's salary: personal income tax (18%); military duty (1.5%);How to register a company in Ukraine for a foreigner?

Tax Implications

General Taxation System

Rates may change, especially regarding the military levy, which is planned to be up to 5%.Simplified Taxation System

1 and 2 groups are available ONLY for sole proprietorships.International Tax Considerations

Employment and Labor Law

Only one of these options, for example, allows you to go through the booking procedure. But which one is right for your business scheme? Here's what you need to consider BEFORE registering.Hiring Employees

Employment Contracts

Wages and Taxes

SSC (22%) from the salary amount.

FAQ

- Is there any specified size of the shares’ capital?

- No. No restrictions on the matter. Just notice that the company's capital must be formed in Ukrainian currency - hryvnia.

- Can I be a Head of more than one company?

- Yes. Person in Ukraine can be a head of several companies.

INTERESTING INFORMATION

If you are really determined to have a successful business in Ukraine, just contact the specialists who have helped to open dozens of such businesses. In the process of work, we: We will develop a plan based on who you will be creating this company with. If it is a foreigner, we will help him draw up documents. If you do not fully trust your partner: we will prescribe a safe system of co-management of the company. We will help you choose the most optimal taxation system. We will fully prepare the entire package of documents. We will carry out the registration process. This can also be done with a trusted notary, whom we will recommend. We will open an account for your company and make an EDS. Personnel records; Accounting; Bank account maintenance; Legal and tax advice.Legal and Accounting Services

In addition, we can stay with you further by closing the following functions in the company:

When choosing a partner in Ukraine, contact someone who has real experience working with foreign clients in the areas you need. This is our company.